costs

Diversity — Undergrad Costs Harms Financial Diversity

In the last two articles on impact of finances and financial diversity in medical school we’ve covered several topics:

- The AAMC and the TDMSAS have recognized a correlation with MCAT & GPA and parental finances (this also includes other factors, such as parental education, household size, etc). Therefore, both agencies encourage medical schools to consider socioeconomic class (SES) within their holistic review of applicants. SES effects all ethnic groups and both genders, though some groups are more likely to have more applicants applying and designated SES.

- We have noted that despite SES consideration, there hasn’t really been an appreciable change in the number of SES designated accepted medical students — calling into question the myth perpetuated by some that SES students are unfavorably gobbling up seats.

- We also covered the obvious caveat to aggregated data, you can’t say much about an individual, all we can do is speak of trends.

Today, in this last installment, the last idea: undergraduate education is growing prohibitively more expensive, therefore it’s a moot point to later hope for SES applicants to flood the application gates.

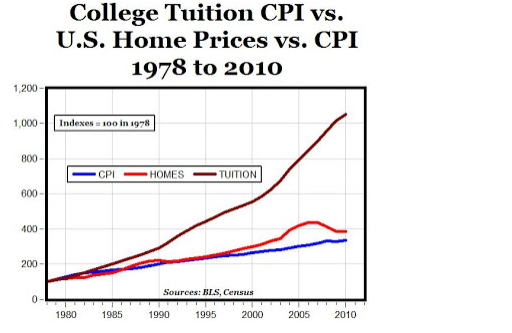

The key to understanding what cost of living in a temporal sense is something called the Consumer Price Index (CPI) — it gives us a barometer of how much more stuff costs now than before on every day items. A rough explanation of CPI versus time is: a flat CPI trend would mean your money is worth just as much now as before, positive slopped CPI would then mean you can buy less of that item you’re using as an index, while if the CPI slooped down it would tell us we’re somehow getting more bang for our buck. So, looking the graph below as an example:

This graph tells us that overall day to day items costs more than before, they were practically giving away houses in the early-mid 80’s, housing wasn’t a get rich scheme yet in the early-mid 90’s, and now housing is rather un-affordable, though there was a “crash” in prices that hurt you if you owned a house after 2008 (aka housing bubble). And the future of housing prices is unknown, you’d need a good risk analyst to give you a good prediction; but it looks like CPI will continue to rise regardless. That was a very long winded way to say stuff costs too much.

Now back to college stuff, undergraduate education costs are surging. In fact, the rising costs of college greatly dwarf the rising CPI and even the housing price increase we saw in the 2008 bubble.

The graph above demonstrates that while in general housing is pretty expensive, it’s eclipsed by the burgeoning tuition rates compared to CPI. Overall, undergraduate education is becoming less and less affordable to those with more meager financial support, and it’s likely the only mediation for these groups is either to qualify for more grants and scholarships or to take out additional loans. It’s also interesting to note that in the same period of time, there was a 4x raise in the cost of housing and medical school (when adjusted for inflation 2011 dollars), but during that same period undergraduate education rose by 10x.

This graph tells us what we already should of ascertained by now: some slivers of society are enjoying a better rate of average income growth given the same period of time, and there is a growing gap between the top quintiles an the lowers. Though, to get a more accurate picture we’d have to include the rate of inflation as in the graph below:

When we look at the data, and it’s adjusted for inflation, we get a more accurate financial picture. All the quintiles, with the exception of a slight creep up in the top two quintiles, all of them were more or less in line of each other from 1967 until about 1984. After 1984, the top 5% (the dash line) left all the other quintiles in the dust– though “top” quintile did see a steady increase. All the other quintiles pretty much make as much in 2012 as they did in 1965. Now, if we look at this self reported household income survey from Berkeley, we can get a snap shot of one college (though it is scant evidence with n =1). I chose Berkeley simply because they were transparent with their data, there was no other reason other than it being a premed generating university:

From a snapshot of Berkeley alone, we can see that in fall of 2010 about 27% of the class claimed parental finances of $80,001-$150,000, 20% claimed $150,000+. While 53% claimed $80,000 and below –not allowing for us to figure how many actually got in from the lowest quintiles. In terms of who’s usually in medical school (the top and 2nd quintiles as displayed above), the 53% Berkeley group would easily consume the bottom till the third quintile and still have enough breathing room to also constitute some of the top quintile. Whereas, the other 47% of Berkeley would be high flying into the top quintile with no reservation. From the start some undergraduate institutions already contain an unusually high family income, especially considering that the average family income is around $65,000. Therefore, unless a dis-appropriate amount of low financial quintile applicants are applying in waves, medical schools are somewhat destined to select from crowds who could afford to be at some universities anyways.

Unfortunately, there isn’t much medical schools can do to stop the undergraduate education finance bubble. Furthermore if college continues to become less affordable, medical schools will likely keep having difficulties recruiting SES applicants (regardless of race) in the first place. While offering pipelines and grants is a good start, to make a real dent in the problem college has to become more affordable — unless someone can explain to me why my 4 year medical school bill would be less than a 4 year degree from Columbia in Fine Art (Columbia tuition is ~$56K per year).

I would like to thank Jesse Columbo for pointing me towards sources. He’s an astute financial analyst, contributor for Forbes; and also given credit by the London Times for predicting the US housing crash in 2008. His articles make for a good sobering read, he’s currently leading the scoop on the education bubble as well, click here to read more of his work: http://t.co/31Is0NjYnt

Accrued Medical School Costs: With Fancy Numbers

twitter: https://twitter.com/masterofsleep

This post will be devoted to discussing how much I’ve spent so far on applying to medical school. Applying to medical school is pretty pricey as you probably already know, I knew this going into it. I tried to adjust accordingly, paring costs when possible. I’ll be the first to admit that I didn’t really want to sit down and calculate my costs, it’s sort of depressing to see the final number because I’m currently pretty poor and my car isn’t even running. Good times, but hey, I’m going to be a doctor!

People have asked how much have I paid in total, it’s a hard question to answer because the process of applying to medical school can extend into April, and it has multiple phases. Although, the secondary application period is closing soon, so schools will no longer accept secondaries and will only be issuing applicants a series of responses: interview invites, and acceptances, wait-list, and rejections. I can only gain an acceptance after interviewing, but I can be rejected at any point of the AMCAS application process. As for me, like many others, I am in the interviewing stage of the process, and there’s a relative calm so I have time to reflect and lament on my lightened wallet.

Save yourself the headache and sacrifice a goat to receive FAP, I didn’t get it but go for it, a lot of people do receive it!

So you can better compare your costs with mine I’ll layout my own experience. I didn’t qualify for FAP, if you did then your costs won’t be as high as mine, so don’t be discouraged there’s hope! Myself, it was a Catch-22, the FAP uses your parents tax returns regardless of your independence status and age. A similar situation happened to me when I was young and applying for FAFSA (FAFSA will finally separate your parents W-2’s when you hit 25), not a great system for those who fall through the cracks.

For the primaries I applied to twenty schools, then from those twenty I completed twelve secondaries. From those twelve secondaries I have received eight interview invitations and one rejection, I’m convinced the other four schools set my application on fire. I was offered four acceptances, I took three and turned down one school. It’s best to withdraw acceptances if you’re truly not interested in attending to make space for others who might be wait-listed. I am awaiting to hear back from one more school this week, if I got in it would mean a lot to me. I also have one more out of state interview lined up that I’ll probably cancel later this week or the next — especially now that I’ve calculated the cost so far.

You might of wondered what happened to the other eight or so. One school I withdrew my primary because I changed my mind about their program. I received two rejections: school 3 primary alone, school 4 after completing their secondary. It didn’t sting that bad because I was already accepted into one program by the time I received my first rejection — I applied very early and interviewed on the first date available. School 5-8 I didn’t complete their secondaries because by that time I had two interviews (including my top choice) completed, several lines up, and I had received two acceptances by that time.

Primaries alone:

I applied to 20 schools during primaries, the first school was $160 and $35 thereafter, so my primaries cost: $860

Secondaries alone:

I completed 12 secondaries (*update 13 II), the prices ranged from a ‘low’ $85 to $150, I’ll go with the low end of $110 per secondary as an average so that makes the secondaries: $1,320

Primary + Secondary: $2,145

Interviews (flights, room & board, transportation):

I have attended 5 interviews so far, all of them a few time zones away. I couldn’t group two of my interviews together, but I was able to group the other three together. Grouping them together is pretty stressful logistically, mentally, and physically, but it’s a lot cheaper to buy a multi-stop ticket than not. To shave costs on room and board I stayed with hosts whenever possible, in one state a friend on twitter housed me (go technology). In case your curious I booked everything on Priceline, and I downloaded an application on my phone to make finding rental cars easier and find coupons.

Plane tickets – $1,800

Hotel – $1,000, I slept in O’Hare Airport on one night *not fun*

Food – $300

Car Rentals – $400

Suit (tailoring for charcoal assemble – $200

Interview total cost — $3,700

If you can be competitive within your state you can skip a large chunk of these costs. If you are from California sign up for frequent flyer miles now.

Time off work: another $1,000

Deposits for acceptances: although I was offered four acceptances, I turned down one, and took three acceptances (two didn’t require deposits, and one didn’t). So it cost me ‘mere’ $100. If I get accepted into the program I’m waiting for next month then I’ll have to plop down a cool $500.

Well, that brings our grand total thus far to $6,980 or $7,480 if I was accepted into my top pick — fortunately, I do get the deposits back in a few months.

Estimating your costs:

So, here are some projections if you apply to medical school the primary applications will cost you in dollars: f(x) = 160+35x (x is #schools for primaries ). However, the cost of the first application may change over time, so let’s assign this a constant, so the first application is $160 + f (x). The secondary applications, g (x),will run you anywhere from 85y and 150y, but really probably somewhere around 110y (where y is the number of secondaries you complete). It’s possible and very likely you won’t complete as many secondaries as you did primaries, that is why I made x and y separate independent variable. However, it is obvious that y is dependent on x, that is the number of schools you get to apply to for secondaries is related to your primaries. So, all that’s left is to make a representation for the cost of interviews, this will vary from none, to a deluge. I can’t predict if you’ll apply in state only etc., so let’s just agree to call all interview costs C. So, the fruit of this dry paragraph is the following equation for you to use to estimate your AMCAS cost (not including the MCAT and possible deposits, variation in application strategies etc.):

cost = A+35x+110y+C , where A = 160, and C varies by person. So cost = A + f (x) +g (x) + C

- A = $160, cost of first application. Cost my change over time.

- x = number of schools you apply to during your primaries. A lot of people apply to around 15-20 schools.

- y = number of schools you put a secondary through, it will be equal or less than x. I went with a conservative $110, you can try anything from $85-150 if you want a range from super cheap to top dollar.

- C = estimation of room & board costs, misc costs.

The largest part of applying to medical school is commitment, I like to consider this sacrifice of my blood to be some type of rite of passage. A symbolic token to say that I’m serious about medicine, at least that’s what I tell myself when I empty my coffers.

Here’s a table of the expenses you should expect at the minimum assuming the fees I stated before:

|

#Schools Applied |

Cost of 1st |

Cost of 2nd |

Cost of 1st + 2nd |

|

1 |

195 |

110 |

305 |

|

2 |

230 |

220 |

450 |

|

3 |

265 |

330 |

595 |

|

4 |

300 |

440 |

740 |

|

5 |

335 |

550 |

885 |

|

6 |

370 |

660 |

1030 |

|

7 |

405 |

770 |

1175 |

|

8 |

440 |

880 |

1320 |

|

9 |

475 |

990 |

1465 |

|

10 |

510 |

1100 |

1610 |

|

12 |

580 |

1210 |

1790 |

|

13 |

615 |

1430 |

2045 |

|

14 |

650 |

1540 |

2190 |

|

15 |

685 |

1650 |

2335 |

|

16 |

720 |

1760 |

2480 |

|

17 |

755 |

1870 |

2625 |

|

18 |

790 |

1980 |

2770 |

|

19 |

825 |

2090 |

2915 |

|

20 |

860 |

2200 |

3060 |

Thank GSM for the 99 cent store.